New Hampshire Insurance Department of Continuity of Care Document

How much could you save on 2022 coverage?

Compare health insurance plans in New Hampshire and check your subsidy savings.

Image: panaramka / stock.adobe.com

New Hampshire health insurance marketplace 2022 guide

Three insurers offer 2022 health plans through state exchange

- Louise Norris

- Health insurance & health reform authority

- January 19, 2022

New Hampshire exchange overview

New Hampshire is one of seven states that utilize a state-federal partnership health insurance exchange for enrollment.

Three insurers are offering 2022 exchange plans in New Hampshire and full-price 2022 premiums in the state are the lowest in New England.

Frequently asked questions about New Hampshire's ACA marketplace

New Hampshire is one of seven states that operates a partnership exchange with the federal government. These exchanges are considered federally facilitated, they use Healthcare.gov's enrollment platform and call center, and receive federal Navigator funding.

But the state also takes an active role, and operates Covering New Hampshire, a resource site for residents to learn about the exchange and the plans that are available. The Department of Insurance has an inclusive overview of exchange information on their website to serve as a resource for state residents, and maintains a monthly enrollment report that shows how many people have plans purchased through the exchange from each participating insurer. As of November 2021, there were 47,378 people enrolled in on-exchange plans in New Hampshire.

For 2022 coverage, there are three insurers that offer exchange plans in New Hampshire:

- Ambetter

- Harvard Pilgrim

- Matthew Thornton/Anthem

For 2014, only one health insurance carrier — Anthem Blue Cross Blue Shield — applied to participate in the state-federal partnership exchange in New Hampshire, offering 14 health plan options. But that changed significantly for 2015, when the New Hampshire exchange grew to include policies from five carriers. Not all carriers offered plans in all counties, but there were an average of 38 plans available in each county, up from 10 in 2014.

Two of the new carriers that joined the New Hampshire exchange in 2015 were ACA-created CO-OPs: Minuteman Health, based in Boston, and Community Health Options (formerly Maine Community Health Options, or MCHO) that garnered 83 percent of the market share in neighboring Maine during the 2014 open enrollment. CHO had a limited presence in New Hampshire 2015, offering coverage in four NH counties: Coos, Carroll, Rockingham, and Strafford.

Harvard Pilgrim Health Care and Assurant also joined the New Hampshire exchange in 2015, although Assurant announced in mid-2015 that they would exit the entire market nationwide, and they no longer had any enrollees in the New Hampshire exchange as of September 2015.

For 2017, Community Health Options was no longer offering coverage in the exchange (they opted to focus entirely on Maine instead, and exited the New Hampshire market at the end of 2016), but plans continued to be available from Anthem, Ambetter, Minuteman Health, and Harvard Pilgrim.

But Minuteman Health was ultimately placed in receivership, and was not allowed to offer coverage past the end of 2017. They had intended to reopen as a new, for-profit insurer in 2018, but did not raise enough capital to make that possible. As a result, Minuteman Health enrollees had to switch to new plans for 2018, and residents did not have an opportunity to buy a for-profit version of Minuteman coverage (the New Hampshire Insurance Department published a list of FAQs about Minuteman's departure from the market).

So for 2018, plans were available in the New Hampshire exchange from Anthem, Ambetter, and Harvard Pilgrim. All three insurers have continued to participate in the exchange ever since.

The open enrollment period for 2022 coverage ran from November 1, 2021 to January 15, 2022. Outside of open enrollment, a qualifying event is necessary to enroll or make changes to your coverage. If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment.

After declining for three consecutive years, average premiums in New Hampshire's individual/family market increased slightly for 2022, but only by about 0.7%. The New Hampshire Insurance Department has noted that average full-price 2022 premiums in New Hampshire are the lowest in New England, and are 14% lower than they would have been without the state's reinsurance program that took effect in 2021 (more details below).

The following average rate changes were approved for 2022, applicable to full-price premiums (ie, these rate changes are calculated before subsidies are applied, and most exchange enrollees receive subsidies):

- Ambetter/Celtic: Average increase of 1.52%

- Anthem (Matthew Thornton): Average decrease of 3.15%

- Harvard Pilgrim: Average increase of 11.28%

The cost of cost-sharing reductions (CSR) has been added to silver plan rates in New Hampshire, as has been the case since 2018. This results in disproportionately large premium subsidies, and after-subsidy rates on bronze and gold plans that are lower than they would have been if the federal government had continued to directly reimburse insurers for the cost of CSR.

And the American Rescue Plan's subsidy enhancements have resulted in larger premium subsidies as well, which are still in effect for 2022. Due to these extra subsidies, coverage is more affordable than it was during any previous autumn open enrollment period.

State law prevents the New Hampshire Insurance Department from publishing health insurance rate information until open enrollment begins on November 1. But the Department is proactive in sharing the information that the federal government publishes at the beginning of August in terms of proposed rates for the coming year.

For perspective, here's a look at how average premiums have changed in New Hampshire's exchange over the years:

- In 2014, premiums were essentially actuaries' best guesses, since there was no market experience on which to base them. The ACA had drastically reformed the individual market, enhancing coverage requirements and eliminating medical underwriting, which was previously the most significant factor in keeping premiums fairly low in the individual market.

- For 2015, average premiums decreased in New Hampshire, due in large part to the fact that the exchange went from having just one insurer in 2014 to having five in 2015. The benchmark plan (second-lowest-cost silver plan) changed as a result of the influx of carriers to the exchange, and the new benchmark plan in 2015 was about 17 percent less expensive than the benchmark plan in 2014. Avalere Health found that the average lowest-cost bronze plan in New Hampshire was 17 percent less expensive in 2015, and that the average lowest-cost silver plan was 18 percent less expensive. The silver drop was the largest in the nation, and the bronze drop was second only to Mississippi.

- For 2016, there were still five insurers, although Ambetter (Celtic) was new to the exchange and Time/Assurant exited the market. Average rate changes were fairly modest, ranging from a decrease of about 2 percent for some of Harvard Pilgrim's plans to an increase of more than 16 percent for some Community Health Options plans. Before rates were finalized in New Hampshire, the worst-case scenario rate increase based on proposed rates was 18.5 percent. But once the rate review process was finalized, the overall weighted average rate hike was just over 6 percent—even if we assume that the majority of Community Health Options, Anthem, and Minuteman enrollees were in plans with the highest rate hikes. According to HHS data, the average benchmark premium (second lowest-cost Silver plan, which isn't necessarily the same plan from one year to the next) in New Hampshire was 5.1 percent more expensive in 2016 than it was in 2015.

- For 2017, there were four insurers offering plans in New Hampshire's exchanges. Average rates increased by 8.8% in 2017, ranging from an average of just 1.35 percent for Ambetter/Celtic, to an average increase of nearly 14 percent for Anthem (Matthew Thornton Health Plan). Minuteman Health (an ACA-created CO-OP) had initially proposed rate hikes that ranged from 18 to 60 percent, but ended up with an average rate hike of just 4.2%, resulting in the lowest-priced plans in the exchange at all metal levels.

- In 2018, Minuteman Health was no longer offering coverage in New Hampshire. The three remaining insurers implemented significant rate increases, but that was due in large part to the fact that the Trump Administration had stopped reimbursing insurers for the cost of cost-sharing reductions (CSR), so insurers added that cost to silver plan rates starting in 2018 (details below). Ambetter's average rate increase for 2018 was 18.4%, Anthem's was nearly 49%, and Harvard Pilgrim's was nearly 46%.

- For 2019, insurers in New Hampshire proposed average rate decreases, likely due in part to the state's plan to stop buying private coverage for Medicaid expansion enrollees and switch to Medicaid managed care instead. Once rate filings were approved, New Hampshire's individual market ended up with an average rate decrease of 14.4 percent.But all three insurers indicated in their filings that they expected the health of their risk pools to deteriorate as a result of the repeal of the individual mandate penalty. Anthem's filing also noted that the risk pool was expected to deteriorate due to "potential movement into other markets." This is likely a reference to the fact that access to short-term health plans and association health plans has been expanded by the Trump Administration (although New Hampshire limits short-term plans to six months and prohibits their renewal; their expansion is not as robust in New Hampshire as it has been in some other states). So although rates dropped in New Hampshire in 2019, they would have declined even more if the individual mandate penalty hadn't been repealed, and if the Trump Administration hadn't expanded access to short-term plans and association health plans.

- For 2020, two of the three insurers decreased their average premiums. At ACA Signups, Charles Gaba calculated a weighted average rate decrease of 0.8 % for 2020 in New Hampshire's individual market (again, keeping in mind that this applies to full-price premiums; net rate changes for people who get premium subsidies can be much different). The New Hampshire Insurance Department created an at-a-glance resource showing which hospitals are in-network with each of the insurers that offer plans in the exchange for 2020, as well as a side-by-side comparison of the benefits offered by each plan.

- For 2021, overall rates decreased again, for the third year in a row. The state's average benchmark rates were the seventh-lowest in the nation as of 2021. The state noted that consumers would likely see large rate decreases for 2021, thanks to the new reinsurance program (details below). But rate decreases stemming from reinsurance are only applicable to people who pay full price. Most people get premium subsidies, and the subsidies decline when overall premiums decline. That means after-subsidy premiums for most enrollees were not necessarily any lower in 2021 than they had been in 2020. According to SERFF data, the overall proposed rate changes for 2021 were approved mostly as-filed, with the following average rate changes implemented as of January 2021:

- Ambetter/Celtic: Average decrease of 4.2 (SERFF tracking number CELT-132344232)

- Anthem (Matthew Thornton): Average decrease of 15.37 percent (SERFF tracking number ATEM-132317439)

- Harvard Pilgrim: Average decrease of 12.9 percent (SERFF tracking number HPHC-132215451)

During the open enrollment period for 2021 coverage, 46,670 people enrolled in plans through New Hampshire's marketplace. This was about 5% higher than the year before, and was the first time enrollment had increased in New Hampshire's marketplace since 2016.

As is the case in many states that use HealthCare.gov, enrollment in New Hampshire's exchange peaked in 2016, and then declined each year through 2020. Here's an overview of enrollment since the exchange began operating in 2014:

- 40,262 people enrolled for 2014 (this greatly exceeded CMS projections).

- 53,005 people enrolled for 2015.

- 55,183 people enrolled for 2016.

- 53,024 people enrolled for 2017.

- 49,573 people enrolled for 2018.

- 44,581 people enrolled for 2019.

- 44,412 people enrolled for 2020.

- 46,670 people enrolled for 2021.

(These numbers do not include Medicaid members who were enrolled in private plans via New Hampshire's Premium Assistance Program (PAP) prior to 2019; PAP enrollees were in the same qualified health plans as other enrollees, but the policies were funded by Medicaid.)

Enrollment in states that use HealthCare.gov dropped for a variety of reasons from 2016 through 2020:

- The Trump administration sharply reduced funding for exchange marketing and enrollment assistance.

- The individual mandate penalty was eliminated.

- The rules have been relaxed for short-term plans, making them more attractive as an alternative for healthy enrollees.

- Premiums have grown considerably, making coverage less affordable for those who don't get premium subsidies (much of the rate increases can be attributed to GOP efforts to sabotage the ACA and the fact that the Trump Administration cut off funding for cost-sharing reductions in 2017 — although that has also resulted in larger premium subsidies, which benefit the majority of enrollees).

Would ACA subsidies lower your health insurance premiums?

Use our 2022 subsidy calculator to see if you're eligible for ACA premium subsidies – and your potential savings if you qualify.

Obamacare subsidy calculator *

Estimated annual subsidy

Provide information above to get an estimate.

* This tool provides ACA premium subsidy estimates based on your household income. healthinsurance.org does not collect or store any personal information from individuals using our subsidy calculator.

Reinsurance program took effect in 2021

As of 2021, New Hampshire and Pennsylvania joined a dozen other states that have implemented reinsurance programs to stabilize their individual insurance markets. Reinsurance works by taking on some of the risk that the health insurers would otherwise have to bear, and the result is lower premiums in the individual market. That translates to smaller premium subsidies, which reduces federal spending. By using a 1332 waiver, a state can recoup the savings (instead of having the federal government keep the money) and use the money to fund the reinsurance program.

New Hampshire's reinsurance program is designed to kick in when a claim reaches $60,000. At that point, the state planned to pay approximately 74% of the claim costs, until the total claim reaches $400,000. But the state's waiver plan notes that the exact parameters (in terms of the percentage of the claim that will be covered and the upper limit for claims to be paid by the reinsurance program) will depend on how much funding the state has for the reinsurance program each year (for 2021, New Hampshire received $31.5 million in pass-through funding, which was considerably more than initially projected).

New Hampshire submitted its reinsurance proposal to CMS in April 2020, and the federal government approved it in early August. The state's initial projection was that the planned reinsurance program would result in 2021 individual market premiums being 16% lower than they would otherwise have been. The state also projected that enrollment in the individual market would increase by about 6% with a reinsurance program in place, due to the reduced premiums (plan selections in the exchange during open enrollment had dropped each year since 2016, so stabilizing enrollment with a reinsurance program was a priority; it's noteworthy, however, that an increasing percentage of people who enroll are paying their premiums: Effectuated enrollment in New Hampshire's exchange in early 2020 was higher than effectuated enrollment had been in early 2019).

Ultimately, enrollment ended up increasing by about 5% for 2021, with 46,670 people buying coverage during open enrollment. Individual market enrollment normally declines throughout the year and then increases during open enrollment. But enrollment remained fairly steady in New Hampshire's exchange in 2021, due to increased enrollment during the COVID-related enrollment window that continued until mid-August 2021.

As noted above, all three of New Hampshire's insurers decreased their overall average premiums for 2021, due in large part to the reinsurance program. It's important to understand, however, that the reinsurance-related reduction in premiums applies to people who pay full price for their coverage. In New Hampshire, that's about 12,000 exchange enrollees (the rest get premium subsidies) plus about 5,500 people who buy their coverage outside the exchange.

For people who get premium subsidies, the subsidies decreased in 2021 in line with the premium decreases (after-subsidy premiums can end up decreasing, staying the same, or increasing, depending on how the benchmark premiums change). Across the entire state, the average proposed benchmark plan premium for 2021 was 21.2 percent lower than the average benchmark premium in 2020. This represented a more significant drop than the overall proposed average rate decrease – across all plans – for 2021.

When the decrease in benchmark premiums is sharper than the overall average rate decrease, the result can be higher after-subsidy premiums for people who get premium subsidies (about 72% of New Hampshire exchange enrollees). Colorado's 2020 premium decreases are an example of this.

However, the American Rescue Plan has boosted premium subsidies at all income levels for 2021 and 2022, and has also eliminated the "subsidy cliff" for those two years. This more than offsets any potential net premium increases that people may have seen due to lower benchmark premium rates in 2021; in almost all cases, coverage is more affordable under the American Rescue Plan than it would otherwise have been.

State switched to Medicaid managed care starting in 2019

The rate decreases for 2019 were likely due in large part to the fact that the state changed the way Medicaid expansion is handled. Through the end of 2018, New Hampshire used Medicaid funds to purchases private plans (qualified health plans, or QHPs) in the exchange for Medicaid expansion enrollees, via the state's Premium Assistance Program (PAP).

However, New Hampshire enacted legislation in 2018 that directed the state to seek federal approval to abandon the PAP system and switch to regular Medicaid managed care instead. New Hampshire submitted a waiver proposal to this effect to CMS in July 2018. Approval was granted by CSM in late November, but that appeared to be just a formality, as the state had already sent notices to enrollees in October, and the QHP insurers had mentioned the impending transition from PAP to Medicaid managed care in their filings that were submitted over the summer.

The new Medicaid expansion program in New Hampshire is called the Granite Advantage Health Care Program, and it took effect in January 2019. The Granite Advantage program initially had a Medicaid work requirement, which was already approved by CMS under the terms of a separate waiver, and also took effect in January 2019. But the work requirement was challenged in court and overturned in July 2019, the same month that the state enacted legislation to modify the work requirement. The work requirement approval was officially withdrawn by the Biden administration in March 2021, so it is no longer part of the state's Medicaid expansion program.

There is a correlation between lower income and poorer health, so with the Medicaid expansion population moved out of the QHP risk pool, the overall health of the pool improves. This reduced morbidity will translate into lower premiums for everyone who remains in the QHP pool. As expected, average premiums in New Hampshire's QHP market declined in 2019, 2020, and 2021 (for 2021, it was due in large part to the state's new reinsurance program), and increased only slightly for 2022.

Unique Medicaid expansion began in 2014, but transitioned to managed care as of 2019

Residents were able to begin enrolling in New Hampshire's expanded Medicaid program as of July 1, 2014, with policies effective August 15 (Medicaid enrollment during the winter and spring was only possible for people who qualified under the state's pre-expansion guidelines).

Medicaid expansion in New Hampshire was a contentious issue, but ultimately then-Governor Maggie Hassan prevailed in her efforts to expand Medicaid, albeit in a privatized fashion. Gov Hassan signed Senate Bill 413 into law on March 27, 2014, paving the way for New Hampshire to become the 26th state to accept Medicaid expansion.

For the first couple of years, the program operated in much the same fashion as it did in other Medicaid expansion states, with the state using federal Medicaid funds to provide New Hampshire Health Protection Program coverage to residents with incomes below 139 percent of poverty.

But starting in January 2016, the state transitioned the NH Health Protection Program's participants to subsidized, private coverage (dubbed the Premium Assistance Program). As described above, New Hampshire abandoned that plan at the end of 2018, and switched to a Medicaid managed care model (the Granite Advantage Health Care Program) with a work requirement. The work requirement was subsequently overturned by a judge, and the Biden administration officially rescinded approval for the work requirement in March 2021.

Legislation and exchange history

The exchange creation process in New Hampshire was a legislative battle. In February 2013, then-Gov. Hassan announced that New Hampshire would operate its health insurance marketplace as a partnership with the federal government.

Prior to the 2012 elections, New Hampshire seemed firmly on a path to relying on the federally facilitated exchange. Former Democratic Gov. John Lynch had no effective means to push back against a Republican-dominated state Legislature that was united against a state-run exchange.

And in 2011, lawmakers passed a bill (enacted into law without Lynch's signature) that prohibited any sort of penalties for New Hampshire residents who fail to obtain health insurance — in direct conflict with the ACA's individual mandate and shared responsibility penalty. The law had no real impact however, because the IRS (a federal agency, not under state control) was responsible for assessing the ACA's penalties, and because the ACA is a federal law that cannot be superseded by state law (the federal penalty was eliminated after the end of 2018; people who are uninsured in 2019 and beyond are no longer subject to a penalty).

But the 2012 elections gave control of the state House to Democrats, put more Democrats in the Senate, and kept the governor's office in Democratic hands. The political shift and a law that allowed the state to take on specific exchange functions enabled the state to adopt a partnership model.

New Hampshire is responsible for plan management and consumer assistance, and the federal government is managing all other marketplace functions. The NH Health Exchange Advisory Board held monthly meetings from 2012 through 2015, the minutes of which are available here.

New Hampshire health insurance exchange links

Other types of health coverage in New Hampshire

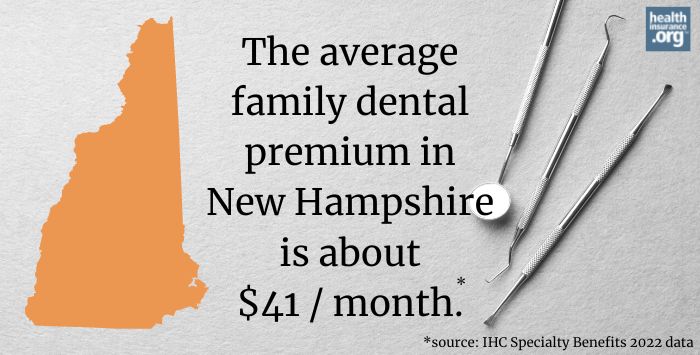

Dental Insurance in New Hampshire

Learn about adult and pediatric dental insurance options in New Hampshire, including stand-alone dental and coverage through the state's marketplace.

mcknightsucan1991.blogspot.com

Source: https://www.healthinsurance.org/health-insurance-marketplaces/new-hampshire/

0 Response to "New Hampshire Insurance Department of Continuity of Care Document"

Publicar un comentario